Yn ystod gŵyl Calan Mai, oherwydd y ffrwydrad hydrogen perocsid yn Luxi Chemical, gohiriwyd ailgychwyn y broses HPPO ar gyfer y deunydd crai propylen. Cafodd cynhyrchiad blynyddol Hangjin Technology o 80000 tunnell/300000/65000 tunnell Wanhua Chemical o PO/SM ei gau i lawr yn olynol ar gyfer cynnal a chadw. Cefnogodd y gostyngiad tymor byr yng nghyflenwad epocsi propan gynnydd cynaliadwy mewn prisiau i 10200-10300 yuan/tunnell, gyda chynnydd eang o 600 yuan/tunnell. Fodd bynnag, gydag allforio Jincheng Petrochemical ar raddfa fawr, ailddechrau cau gorsaf bŵer Ffatri Sanyue am gyfnod byr oherwydd ffrwydrad pibellau, ac ailgychwyn gwaith Ningbo Haian Cyfnod I, mae'r cynnydd yng nghyflenwad diogelu'r amgylchedd a propylen wedi bod yn sylweddol. Mae'r galw i lawr yr afon yn wan, ac mae pryderon bearish yn dal i fodoli ymhlith gweithredwyr. Felly, mae angen pryniannau gofalus. Yn ogystal, mae polyether Covestro yn yr Unol Daleithiau wedi dwysáu cystadleuaeth yn y farchnad borthladdoedd, gan arwain at ddirywiad cyflym yn y farchnad o epocsi propan i polyether. O Fai 16eg ymlaen, mae pris ffatri prif ffrwd yn Shandong wedi gostwng i 9500-9600 yuan/tunnell, ac mae prisiau rhai dyfeisiau newydd wedi codi i 9400 yuan/tunnell.

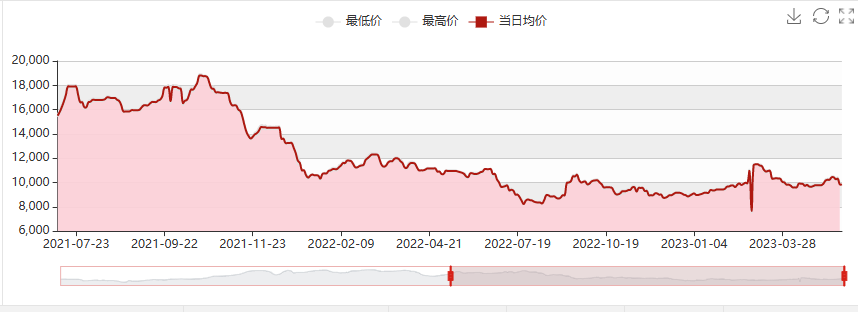

Rhagolwg marchnad ar gyfer propan epocsi ddiwedd mis Mai

Ochr gost: Mae prisiau propylen wedi gostwng yn sylweddol, mae ystodau clorin hylif yn amrywio, ac mae cefnogaeth propylen yn gyfyngedig. Yn ôl y pris clorin hylif cyfredol o -300 yuan/tunnell; Propylen 6710, mae elw'r dull clorohydrin yn 1500 yuan/tunnell, sy'n sylweddol ar y cyfan.

Ochr y cyflenwad: Bydd dyfais Zhenhai Cyfnod I yn cael ei rhoi ar waith o fewn 7 i 8 diwrnod, gyda'r llwyth bron yn llawn; disgwylir i Jiangsu Yida a Qixiang Tengda ailgychwyn; O'i gymharu â mis Ebrill, mae cynnydd swyddogol Jincheng Petrochemical mewn gwerthiannau allanol yn sylweddol. Ar hyn o bryd, dim ond gostyngiad llwyth Shell a dyfeisiau Jiahong New Materials (parcio i ddileu prinder, dim rhestr eiddo i'w gwerthu, wedi'i gynllunio i ddechrau gweithredu o Fai 20fed i 25ain, a danfon ar ôl cychwyn) a Wanhua PO/SM (300000/65000 tunnell/blwyddyn) fydd yn cael eu cynnal a'u cadw'n barhaus am tua 45 diwrnod gan ddechrau o Fai 8fed.

Ochr y galw: Mae gweithgaredd y farchnad eiddo tiriog genedlaethol wedi lleihau, ac mae'r farchnad yn dal i wynebu pwysau tuag i lawr. Mae cyflymder adferiad y galw i lawr yr afon am polywrethan yn araf ac mae'r dwyster yn wan: mae'r haf yn disgyn, mae'r tymereddau'n codi'n raddol, ac mae'r diwydiant sbwng yn symud i'r tymor tawel; Mae pŵer galw'r farchnad modurol yn dal yn wan, ac nid yw'r galw effeithiol wedi'i ryddhau'n llawn; Mae offer cartref/peirianneg piblinell inswleiddio gogleddol/Mae angen codi rhai prosiectau adeiladu storio oer, ac mae perfformiad yr archeb yn gyfartalog.

Ar y cyfan, disgwylir y bydd y farchnad epocsi propan domestig yn parhau i fod yn wan ddiwedd mis Mai, gyda phrisiau'n gostwng o dan 9000.

Amser postio: Mai-17-2023